Managing finances can be a daunting task, especially when it comes to setting a monthly budget. It’s not uncommon to feel overwhelmed or unsure of where to start. Questions like “How much should I spend on rent?” or “What’s a reasonable amount to allocate for groceries?” can leave you feeling frustrated and uncertain.

However, having a solid monthly budget in place can help you achieve your financial goals and lead to a more stress-free life.

In this article, we’ll discuss some of the common challenges and worries that come with setting a monthly budget, and provide you with practical tips and advice to help you create a budget that works for you.

What is a Monthly Budget

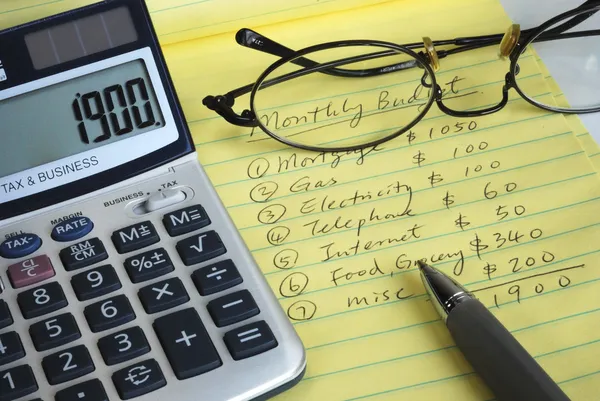

A monthly budget is a financial plan that outlines your income and expenses for a given month. It helps you keep track of your spending and make sure you don’t overspend. A budget typically includes a list of all your income sources, such as your salary or wages, and a breakdown of your expenses, including your fixed and variable expenses.

Fixed expenses are those that remain the same each month, such as rent or mortgage payments, car payments, and insurance premiums. Variable expenses are those that can change from month to month, such as groceries, entertainment, and clothing.

Importance of Having a Monthly Budget

Having a monthly budget is important for several reasons. First, it helps you manage your money more effectively. By tracking your income and expenses, you can identify areas where you may be overspending and make adjustments to your spending habits.

Second, a budget helps you save money. By setting aside a portion of your income each month for savings, you can build an emergency fund, save for a down payment on a house, or invest in your retirement.

Third, a budget helps you plan for the future. By knowing how much money you have coming in and going out each month, you can plan for irregular expenses, such as car repairs or medical bills, and avoid going into debt.

Tips for Creating a Monthly Budget

Creating a monthly budget can seem overwhelming, but it doesn’t have to be. Here are a few tips to help you get started:

- Use a budget calculator or template to help you get organized.

- Categorize your expenses into needs and wants. Needs are essential expenses, such as rent, food, and utilities. Wants are non-essential expenses, such as dining out, entertainment, and hobbies.

- Consider using a zero-based budget, which means that you allocate all of your income to different expense categories, including savings, until you have zero dollars left over.

- Track your spending throughout the month to make sure you stay on track.

- Include deductions from your paycheck, such as taxes and retirement contributions, in your budget.

- Plan for irregular expenses, such as car repairs or medical bills, by setting aside money each month in a separate savings account.

- Use the 50/30/20 budget rule, which suggests that you allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

By following these tips, you can create a monthly budget that works for you and helps you achieve your financial goals.

How to Calculate Your Monthly Budget

When it comes to managing your finances, creating a monthly budget is an essential step. Knowing how much you can afford to spend each month can help you avoid overspending, reduce debt, and reach your financial goals. Here’s how to calculate your monthly budget:

Determining Your Monthly Income

The first step in creating a budget is to determine your monthly income. This includes your paycheck, any additional income you receive, and any payroll deductions. If you’re a freelancer or have a side hustle, be sure to include that income as well.

To calculate your monthly income, add up all your income sources for the month. If you have a regular paycheck, use your net income (after taxes and payroll deductions). If your income varies from month to month, use an average of your income over the past few months.

Identifying Your Fixed and Variable Expenses

Next, identify your fixed and variable expenses. Fixed expenses are bills that stay the same each month, such as rent, utilities, and car payments. Variable expenses are bills that can change from month to month, such as groceries, transportation, and entertainment.

To identify your fixed and variable expenses, make a list of all your bills and expenses for the month. Use a budget template or worksheet to help you organize your expenses into categories.

Creating a Budget Plan

Once you’ve identified your income and expenses, it’s time to create a budget plan. The 50/30/20 rule is a popular budgeting method that suggests allocating 50% of your income to necessary expenses (such as rent, utilities, and groceries), 30% to nonessentials (such as subscriptions, entertainment, and meals out), and 20% to debt repayment and savings.

To create a budget plan using the 50/30/20 rule, start by allocating 50% of your income to necessary expenses. This includes rent, utilities, groceries, transportation, and any other bills that you need to pay each month. Then, allocate 30% of your income to nonessentials, such as subscriptions and entertainment.

Finally, allocate 20% of your income to debt repayment and savings. This includes paying off credit card debt, making loan payments, and contributing to an individual retirement account (IRA).

Be sure to include all your expenses in your budget plan, including irregular expenses such as car maintenance, property taxes, and HOA fees. Use line items to break down your expenses into specific spending categories, such as housing, transportation, and insurance.

Remember, your budget plan should reflect your financial priorities and spending habits. If you find that you’re overspending in certain areas, adjust your budget accordingly. By creating a monthly budget and sticking to it, you can take control of your finances and work towards your financial goals.

How to Stick to Your Monthly Budget

Creating a monthly budget is an essential step towards achieving your financial goals. However, sticking to your budget can be challenging. In this section, we will explore some tips to help you stick to your monthly budget.

Track Your Expenses

One of the most crucial steps in sticking to your budget is tracking your expenses. You can use various tools such as spreadsheets, budgeting apps, or pen and paper to track your expenses. Make sure to record all your expenses, including your irregular expenses, such as car maintenance, medical bills, and home repairs.

By tracking your expenses, you can identify areas where you overspend and make adjustments to your budget accordingly. You can also use this information to create a realistic budget that reflects your spending habits.

Make Adjustments to Your Budget

Your budget is not set in stone. You may need to make adjustments to your budget as your financial situation changes. For example, if you receive a pay raise or start a side hustle, you can increase your income and adjust your budget accordingly.

You may also need to make adjustments to your budget if you have unexpected expenses, such as medical bills or car repairs. In such cases, you may need to cut back on your discretionary expenses, such as eating out or entertainment, to stay within your budget.

Increase Your Income

Increasing your income is another way to stick to your monthly budget. You can explore various options, such as asking for a raise, working overtime, or taking up a side hustle. By increasing your income, you can pay off your debt faster, build your emergency fund, or save for your financial goals.

However, it’s essential to balance your work and personal life and not burn out. You should also consider the tax implications of additional income and adjust your budget accordingly.

Sticking to your monthly budget is an essential part of your financial life. By tracking your expenses, making adjustments to your budget, and increasing your income, you can achieve your financial goals and live a stress-free life.

Practical example to help

Vincent is a 28-year-old software engineer who recently started working at a tech company. He earns $3000 a month after taxes. Vincent has been living paycheck to paycheck for the past few months and he realizes that he needs to create a monthly budget to manage his finances better.

Vincent starts by identifying his monthly expenses. He lists down his rent, utilities, groceries, transportation, and other miscellaneous expenses. He realizes that his rent and utilities cost him $1200 a month, groceries cost him $400 a month, transportation costs him $200 a month, and other miscellaneous expenses cost him $300 a month. Vincent also sets aside $300 a month for savings.

After identifying his expenses, Vincent calculates his income and expenses to determine his disposable income. He subtracts his expenses from his income and realizes that he has $500 left each month. Vincent decides to allocate this money to his savings account, so he can build an emergency fund.

Vincent tracks his spending each month and makes adjustments as needed. He realizes that he’s been spending more on groceries than he initially budgeted for, so he decides to cut down on eating out and start meal prepping to save money.

Thanks to his monthly budget, Vincent is now able to manage his finances better and save money for his future goals. He feels more in control of his finances and has peace of mind knowing that he’s prepared for unexpected expenses.

Frequently Asked Questions

What is a good monthly budget for a single person?

The answer to this question depends on various factors such as your income, expenses, and lifestyle. However, a good rule of thumb is to allocate 50% of your income towards necessities such as rent, utilities, and groceries, 30% towards discretionary spending such as dining out and entertainment, and 20% towards savings and debt repayment.

What is the average monthly budget for a family of four?

The average monthly budget for a family of four varies depending on the location and lifestyle. However, according to the Bureau of Labor Statistics, the average monthly expenses for a family of four in the United States is around $5,000 to $7,000.

What is a good way to calculate my monthly budget?

A good way to calculate your monthly budget is to start by tracking your income and expenses for a month. This will give you a clear idea of how much you are earning and spending. Once you have a clear picture, you can allocate your income towards necessities, discretionary spending, and savings.

What are the typical monthly expenses for a family of five?

The typical monthly expenses for a family of five vary depending on the location and lifestyle. However, some common monthly expenses include housing, utilities, groceries, transportation, healthcare, and education.

What is the average monthly spending for a household?

The average monthly spending for a household varies depending on the location and lifestyle. However, according to the Bureau of Labor Statistics, the average monthly household spending in the United States is around $5,102.

What are some tips for budgeting with $2,000 a month?

If you have a monthly budget of $2,000, it is important to prioritize your spending. Allocate 50% towards necessities such as rent, utilities, and groceries, 30% towards discretionary spending such as dining out and entertainment, and 20% towards savings and debt repayment. It is also helpful to track your spending and make adjustments as necessary to stay within your budget.

Conclusion

Creating and sticking to a monthly budget is an essential part of managing your finances and achieving your financial goals. While it can be challenging to get started, taking the time to identify your income and expenses, set financial goals, and allocate funds to various categories can help you gain control over your finances and reduce stress.

When you follow the practical tips and advice provided in this article, you’ll be well on your way to creating a solid monthly budget that works for you. Remember, it’s never too late to start taking control of your finances, so take the first step today and start creating your monthly budget!

YOU SHOULD ALSO READ: